Demonetisation

Source –Business Line

Date of

Publication-Wednesday 8 November 2017

Note – Many students

are making project on demonetization The below article which has been taken

from business line shows the positive view of demonetization

It can be a great help

to students who are preparing for project and also for group discussion in various

entrance examination

Topic Demonetization

Adapted

from - It’s a major structural change

Author

– Arun Jaitley – Finance Minister

Synopsis – Finance Minister believes that the

initiative has also introduced a higher degree of ethics in Indian society

Q1 India is a cash dominated economy What does it

mean

Answer

1 India is one of the

few economies in the world which has been excessively cash-dominated. A

cash-dominated economy has several features, the most obvious being that the

percentage of cash currency in circulation in relation to GDP is very high. In

India, it was between 12 and 12.5 per cent; 86 per cent of this currency was

high denominational — Rs 500 and Rs 1000.

Q2 What is the effect

of cash economy in our country in terms of economics?

Answer 2 It would also

lead to economic activity. But this informal economic activity would be outside

the formal order. The net result has been that the size of the formal economy

contracted and that of the shadow economy became much larger

Q3 What is social

impact of cash economy

Answer 3 Social

impact

Cash also has social

consequences. It leads to corruption. The instrument of bribery is always cash.

Cash leads to expenditure on conspicuous items like gold and luxury items. Cash

is also the instrument for fuelling crime, extortion. Terrorism thrives on cash.

And, therefore, in the larger national and public interest as also for good

economic reasons, the quantum of cash in the society and the economy has to be

curbed.

Q4 What steps

government has taken earlier to curb the black money previously

Answer 4 a) In 2011, the

Supreme Court had asked the Government to appoint a Special Investigation Team

(SIT) headed by two retired judges.

b) A scheme was introduced that those who have

illegal money and assets abroad must bring them back on payment of 60 per cent

tax and penalty or they will be prosecuted. The Black Money Law for overseas

assets was enacted and it provided for a 10-year punishment.

c) The government started entering into

agreements with countries across the world through G20, the FATCA agreement

with the US to improve international tax compliance through mutual assistance

in tax matters, agreement with Switzerland so that we can get real-time

information with regard to transactions done by Indians overseas and

vice-versa. Three major international double tax avoidance treaties with

Mauritius, Cyprus and Singapore have been rewritten.

d) The government then brought in the Benami law which brings

into its ambit businessmen and politicians alike and applies to shell companies

through which money is laundered. We brought in the income disclosure scheme to

disclose income which has escaped assessment.

e) Finally, on

November 8, 2016, the Government took the historic decision of demonetising the

Rs 500 and Rs 1000 notes.

Q6 What were the objectives and

achievement of demonetization

Answer6 a) The first, of

course, was that the quantum of cash should be curbed.

b) The number of

individuals paying tax and filing assessments has significantly increased

c) An incidental

advantage that we have seen is that freezing of funds of terrorists operating

in Jammu and Kashmir and Chhattisgarh has taken place. The nature of protests

there which depended on large economic resources has altered.

d) A

currency note is a bearer document. Its ownership is anonymous. The moment it

gets deposited in the bank account, it gets identified with the owner. The onus

is now on the owner to show that the acquisition of such a large amount of

money was legitimate or otherwise. And under Operation Clean Money, we have

been able to identify through data mining 1.8 million people who made deposits

disproportionate to their known sources of income.

Questions for Viva for the students who are making project

on demonetization

Has the use of cash

come down post demonetisation?

The currency with the

public is down by Rs. 3 lakh crore. The positive spin is that Indians are

getting out of the cash habit and are moving to non-cash payment. The negative

spin is that the reason the cash has not come back is that the cash economy is

in such bad shape that they can’t absorb that money.

What has happened to

black money?

There is total

confusion. Black money is not kept under the pillow or in bank lockers. It is

almost always put to some use. It is either used to buy valuables like real

estate and gold or is anonymously invested in stocks or sent abroad. A bulk of

it goes into financing the informal sector. All this is black money because it

is not taxed. All this came back into the banking system and all of it except

Rs. 3 lakh crore has again been withdrawn. GST will make a lot of impact on

black money as it will help generate a paper trail.

One year later, what

has been the impact of the note-ban on the economy?

Agriculture has

suffered quite significantly and, in effect, there have now been three

successive years of agriculture distress — two because of droughts and one

because of demonetisation. Last year’s kharif crops were partially compensated

and were reasonable but the full impact of demonetisation was on this year’s

rabi crop. There has also been slackening of demand for corporate India.

The rupee appreciated

significantly and imports shot up. So domestic companies have been unable to

expand their exports and are having a hard time maintaining their market share

in India through import competition.

Are there chances of a

revival in the economy from the second quarter?

I think the entire

year is going to be bad. In the second quarter, there will be two conflicting

influences operating. The positive effect will be that the de-stocking before

GST will be reversed.

The negative effect is

that supply chain problems arising out of GST will start playing out. But, from

the third quarter, we will only be left with the GST effect, which will be

negative.

The impact of

demonetisation on demand will also continue until the rural sector picks up. We

have to carefully watch what’s happening at the mandi level to the kharif crop

which comes in now. If there is another price crash, we are in deep trouble.

It’s a year since the

government opted for demonetisation. Do you still believe it was a right

decision, given its impact on the GDP?

I still stand by my

views on demonetisation. It is a decisive attack on the whole culture of black

money. You can say it is draining the swamp. Yes, there has been an impact on

GDP. But a major decision like this comes at a cost. The process of changing

the culture of illegality is slow but it is happening. It is wrong to say that

all blackmoney has turned into white. It has turned grey. The dubious money is

now sitting in bank accounts that are under scrutiny. See for example the

changing process in defence and real estate. Yes, economic activities were

impacted by this. But this was because the economy was readjusting itself to

the changed structure. Today dishonesty is not incentivised.

But how do you assess the

success of demonetisation, considering the RBI is still counting the currency?

This is a constant

question. How much has come in? Why don’t you see it like this — there are 18

lakh accounts, of which 13 lakh accounts have been identified and are under

scanner, about 4,000 accounts have already been acted against by the

government. These have yielded ₹5,000 crore. The whole process has sent a strong signal to all

that there is no scope for such activity.

Some critics say — won’t

dumping the currency have sent a stronger message...

If the government had

instructed something like this it would have created a ripple (smiles), created

a thrill, but would not have achieved the desired impact. Things have to be

done step-by-step.

Debate has also taken place

on the frequency of demonetization and whether the government should do away

with high-denomination notes (₹2,000). As an economist what

will you propose?

Not demonetisation,

but currency replacement can happen if, say, the government wants to shift to

all-plastic instead of paper, or to make certain changes in a particular

denomination. As regards the higher denomination currency, I would think a

better idea is to do how it is done in the developed world — link it to per

capita income. In the US, the highest denomination is $100 when the per capita

income is nearly $40,000. We have to similarly calibrate our currency.

Hasn’t GST impacted the

consumption pattern?

We have to see

everything in a perspective. See what kind of economy we want. Do you want to

be Japan or you want to be Brazil? India should target Japan, where the set-up

is aimed at larger growth of the middle-class. The Japanese society has far

less inequality and yet prosperity for the middle-class.

GST has impacted the

consumption demand, but of luxury items, not rural consumption.

The rural economy has

not been impacted because agriculture has been out of income-tax net. Success

will come about if this move leads to replacing consumption demand with

investment demand.

To clean up the economy there

have to be major reforms in the taxation structure. The government has taken a

major initiative in indirect tax reforms (GST). What about direct taxes?

Yes, I agree. But

credit to this government that it has taken the initiative of cleansing a

termite-ridden system that was never touched by successive governments earlier.

Today, the tax system is far more transparent.

For direct tax also

there is everything online just as is the case with indirect tax now. More will

happen.

How to move to a cash less economy

How to move to a cash less economy

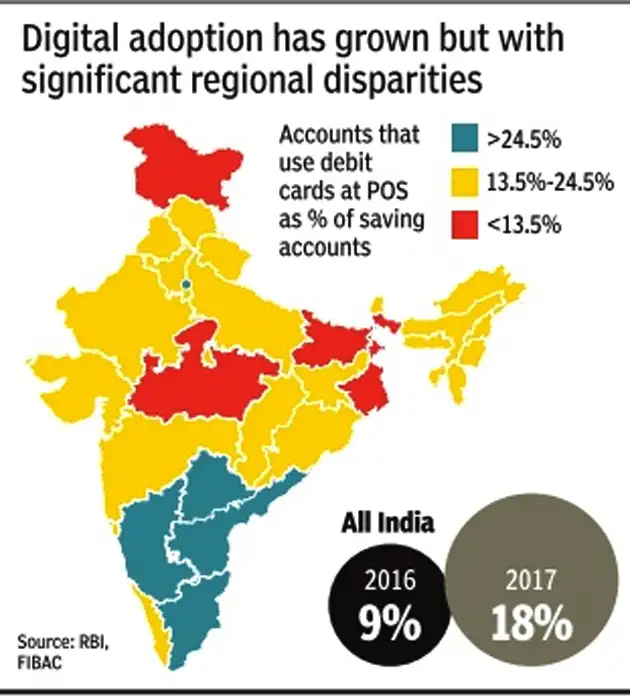

Despite the push to cashless transactions through a variety of digital

payment options, Indians seem to be going back to using cash a year

after demonetisation. A recent study by MicroSave tracks the efforts to

promote a less cash society by public sector banks and the National

Payments Corporation of India.

Key Steps: “The task of building a less cash eco-system is colossal but not impossible,” according to the study.

Identify and on-board merchants: Merchants become critical in promoting a less cash ecosystem, especially in rural India.

Installing acceptance infrastructure: Once merchants have been

on-boarded, banks must provide appropriate acceptance infrastructure at

their shops. Options can include economical and compact card swiping

m-PoS terminals or platforms such as BHIM Aadhaar Pay, Bharat QR Code

Train merchants to facilitate digital payments: Merchants must be trained in conducting digital transactions, and in turn they can train customers, especially in rural areas.

Customer education: Mass media platforms, financial literacy

campaigns, live, hands-on training on digital transactions and create

“product champions” at the village level to promote a steady uptake of

digital payments.

Comments

Post a Comment